Customer Spotlight on A + Nail Spa in Kings Grant Commons Raleigh, North Carolina.

Middle Creek Insurance is happy to offer insurance products for Nail Salons, Beauty Shops and Barber Shops. No matter what stage of growth your shop is at, we are here to lend our expertise to help you find the necessary insurance products and solutions to match your business.

We love celebrating the successes of our commercial insurance clients, and today we are shining the light on A+ Nail Spa, a cozy haven for those seeking unique and stylish manicures and pedicures, located in Raleigh, NC. This April, A + Nail Spa celebrated their 16 year anniversary.

Situated in Kings Grant Commons by the intersection of Fayetteville Road & Ten-Ten Road between Harris Teeter Grocery Store and Woofgang Bakery & Grooming, A + Nail Spa offers a variety of Nail options (Gel Polish, Dip Polish, Acrylic Nails, and traditional manicures and pedicures). While appointments are recommended, walk-ins are welcome. Mother / Daughter treatments are very popular, too.

Getting ready for that special holiday? Super important interview? Don’t forget the finished look of matching nails to your outfit or costume.

Some of our favorite products? I enjoy a dipped polish with colored tips (check out hot pink!) for a look professional that lasts for weeks.

We are proud to provide insurance solutions that help A + Nail Spa focus on what they do best – making gorgeous fingers and toes! Supporting small businesses like A + Nail Spa is what we love to do. If your nail salon, hairdressing studio or barbershop needs an insurance review, don’t hesitate to give us a call at 919-524-2149. We’re here to help you protect your business, so you can focus on making it grow.

What types of insurance could your nail salon need? Most nail salons need coverage similar to other small businesses.

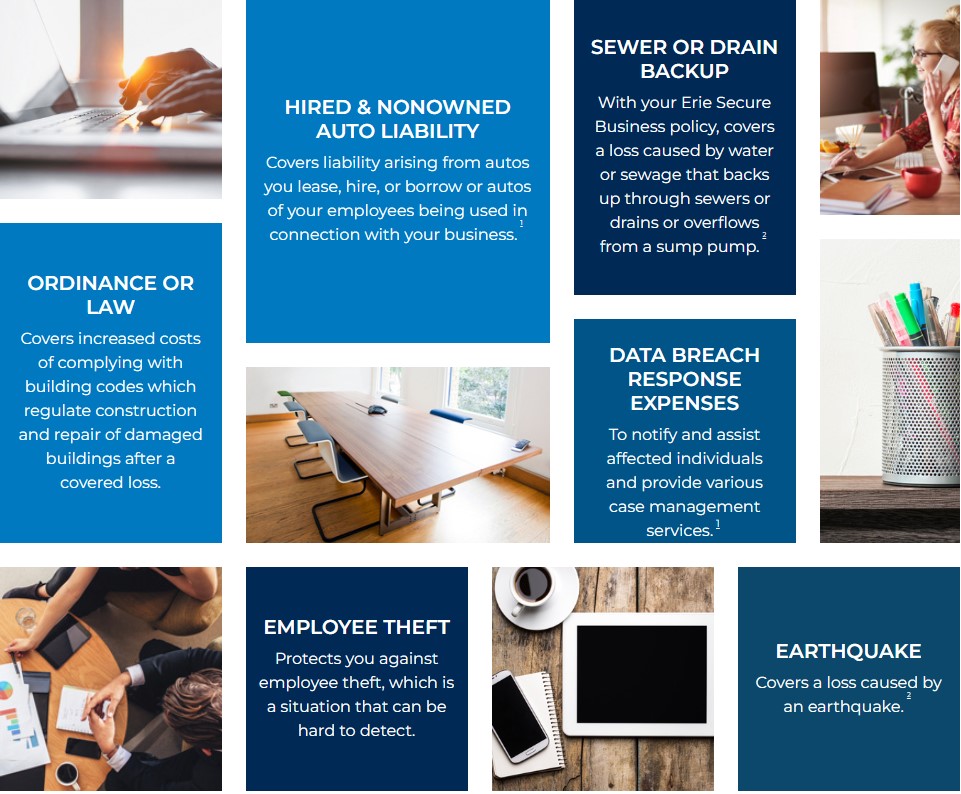

Commercial property insurance: Commercial property insurance helps protect the building or physical location you work in, whether it’s owned with property coverage or leased with liability coverage for damage that’s your fault. It could also replace damaged or stolen assets like equipment and product inventory. Some policies, like business interruption coverage, can even help recover any income you lost while your doors were closed due to a covered loss.

General liability insurance: While specific liabilities may vary from business to business, a general liability policy protects you against covered claims alleging bodily injury or property damage.

Employment Practices Liability (EPL): Legal issues stemming from alleged discrimination, wrongful termination and harassment are growing concerns for today’s small business owner. With EPL coverage from ERIE, you can choose the protection that best fits your needs to help cover the costs of a lawsuit – even if the charges aren’t true.

Commercial auto insurance: Whether you rely on a single car or a large fleet of vehicles, commercial auto insurance is something many businesses need. This coverage can protect your business against claims for bodily injury and property damage caused by a covered accident arising out of the use of a company vehicle

Cyber Suite: Protection for cyber incidents isn’t just for large businesses. With Cyber Suite1 from ERIE, you’ll be prepared to respond to a wide range of cyber incidents including breaches of personally identifying or sensitive information and threats that could jeopardize the safety of that information.

Workers’ compensation insurance: Often referred to as workers’ comp, this policy is legally required in North Carolina if you have three employees. It helps cover medical care and lost wages for an employee who is hurt at work and cannot return.

Business umbrella policy: No matter how careful you or your employees are, mistakes and accidents, unfortunately, do happen. That’s why many business owners make the smart decision to protect themselves with extra business liability insurance. ERIE’s business umbrella is an additional layer of coverage that gives you extra protection and peace of mind above and beyond your commercial general liability, professional liability, business auto liability and employers liability insurance.

Professional Liability Insurance: Fortunately, a professional liability insurance plan will cover you, your business, and your employees if you were negligent while providing services. This is pretty important, especially because we know mistakes can happen. Let’s take a look at an example.

Imagine you’re offering a pedicure to one of your customers. You apply a moisturizer cream, and it creates a severe allergic reaction, causing your customer to rush to the emergency room. Later, your customer sues you for medical costs and emotional distress. If you have professional liability insurance, you should be covered. You won’t have to worry about paying for legal costs and medical bills, up to the limit of your policy. We highly recommend cosmetologists get professional liability insurance because of the risks in their line of work. In fact, most salons, wedding venues, and other spaces may require you to carry proof of insurance before doing work.

Other coverages and endorsements are available –

- 1Available for purchase as an additional coverage on select policies.

- 2Available for purchase as an additional coverage.