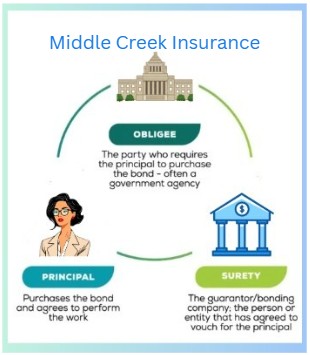

When someone talks about “insurance bonds,” there are many different types. A surety bond is a three party guarantee put in place to protect an obligee and guarantees the performance, ability, honesty and integrity of the individual principal.

Contract Bonds

Contract bonds help protect a project owner from financial loss if the bonded contractor fails to fulfill the terms and conditions of a contract agreement. Middle Creek Insurance offers several contract surety bonds:

- Bid or Proposal Bond

- Maintenance Bond

- Payment Bond

- Performance Bond

- Supply Bond

The approval process requires the prequalification of the contractor. Middle Creek Insurance also offers a quick bond approval program for those contractors in need of a bond under $500,000.

License and Permit Bonds

A license or permit bond helps ensure that a business complies with appropriate license and permit regulations as required by state law, municipal ordinance or by some other regulation and in some instances by the federal government or its agencies. The available bonds are:

- Auctioneer Bond

- Electrician Bond

- Fuel Dealer Bond

- Gasoline Tax Bond

- Liquor and/or Beer Bond

- Motor Vehicle Dealers Bond

- Plumbers Bond

- Real Estate Broker Bond

Public Official Bond

The public official bonds are required by states, counties, municipalities or another political subdivision other than the federal government. They are designed to guarantee the public that the newly elected or appointed official faithfully will perform the duties of that office. The bonds offered are:

- Clerk, City or Clerk-Treasurer Bond

- Clerk of Court Bond

- Constable Bond

- Notary Public Bond

- Sheriff or Deputy Sheriff Bond

- Treasurer-State, County, City, School Bond

Court Bonds

Middle Creek Insurance offers both judicial and fiduciary bonds. Judicial bonds may be required by either the defendant or the plaintiff in connection with litigation. The bonds that are available include:

- Indemnity to Sheriff Bond

- Injunction-Plaintiff Bond

- Liquidator Bond

A fiduciary bond guarantees that a person appointed by the courts to handle affairs of another will be faithful in his/her duties. The available bonds are:

- Administrator Bond

- Guardianship Bond

- Trustee Bond

Miscellaneous Bonds

The bonds that fall into the miscellaneous category generally have characteristics of guaranteeing the payment of monies. They include:

- Lost Instrument Bond – Stocks, Bonds, Checks and Certificates of Deposit

- Wage and Payment Bond

You know that project owners can ensure they pick qualified bidders by requiring a bid bond. However, the bid bond does not protect the project owner beyond the bidding process. To provide a guarantee that the project will be completed, owners can require a performance and payment bond. Performance Bonds provide assurance to the project owner if a contractor fails to complete the work specified in the contract and within the allotted time frame.

Payment Bonds work in conjunction with performance bonds and ensure that laborers, suppliers and vendors will be paid by the contractor, preventing liens on the project that can affect the project owner and the success of the project.

Performance and payment bonds can be requested by any project owner, but most often these bonds are required for government owners (i.e. federal, state, and local government agencies). On all federally funded projects of $100,000 or more, performance and payment bonds are required by legislation known as The Miller Act passed in 1935. Many states and municipalities have adopted so-called “little Miller Acts” that extend similar surety bond requirements to state and local government projects.

More questions? Call us at 919-524-2149 to help you get the bond you need for your next project!